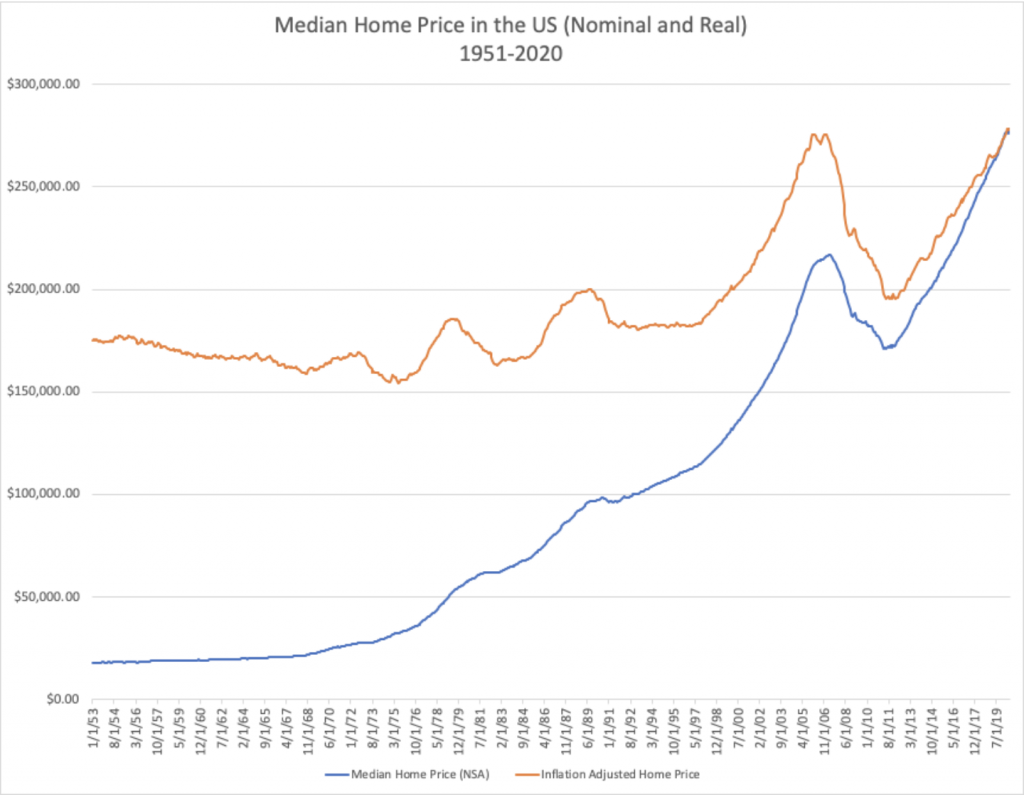

Home prices are undoubtedly high, but exactly how high are they? According to this article by the mortgage reports, home prices hit a record high in 2020 with median home prices exceeding $320,000 for the first time in history. For many, this brings back uncertainty as “all-time high home prices” sounds eerily similar to the housing market crash of 2008. While there is no denying the overall relation to pricing currently and pricing in 2006, experts in the field believe we still have time before a real estate slump will occur in the event that a slump occurs at all.

While home prices are certainly up, factors such as Covid-19, decreased Federal Funds Rates and an increase in the number of qualified homebuyers continue to drive prices up.

Here’s what we know:

Covid-19’s effects on real estate pricing:

The novel Coronavirus is a major player in today’s real estate growth. Consider the following:

- Homeowner’s are spending more time in their homes and oftentimes needing dedicated office space or a quiet area to work in their home.

- Many Americans received a somewhat significant stimulus payment and never lost their job. This afforded the opportunity to pay off debt or save more towards a down payment.

- Due to the coronavirus, the federal government cut the federal fund rate making homes much more affordable. With lower interest rates, buyers are able to pay more towards the principle price of the home without exceeding their set mortgage budget.

These factors in addition to the state of the RE economy prior to Covid-19 led to an influx of qualified buyers. With an increase in the number of qualified buyers and relatively little new housing inventory since 2008, this led to a simple problem of supply and demand.

Less supply combined with more demand leads to higher prices.

What about the adverse effects of covid-19 on the economy?

Covid surely did more destruction than it did good for the economy, but industry leaders still believe that the real estate market is trending to increase this year.

According to this article, foreclosures will occur but the numbers will be very minor in comparison to the great recession where over 7.8 million Americans lost their homes. Due in part to government-mandated forbearance, strong consumer savings and rising home prices the number of struggling homeowners is far below expectations.

How does the pandemic differ from the great recession and housing crash of 2008?

While history tends to repeat itself, all arrows are pointing to us “learning a few things” from the housing crash. The main difference: smart money vs dumb money. What do I mean by these terms? For a full breakdown, consider reading this article. In short, lenders and the feds decided that maybe they shouldn’t give loans to people without making sure they could really afford them. Seems obvious right? It is.

Considerably less shady deals have been made since 2008. If you can’t afford a house, it’s somewhat difficult to get a loan on said house. Prior to 2008, that simply was not the case. Sign the line and try to make the payment.

Sounds crazy right? Maybe even “dumb”? This is the key difference to the loans people have now.

In Conclusion:

Home prices are high, but they are expected to go higher. If you’ve been waiting to buy based on a hunch that prices will fall with the current climate of the economy, you might have to wait a bit longer.

Looking to invest? Now might still be a good time.